Choosing the right travel insurance for France is a decision that often feels confusing or unnecessary to some travelers, yet for cautious international visitors it represents one of the most important layers of protection when crossing borders, navigating unfamiliar healthcare systems, and dealing with unpredictable situations far from home.

France is a country with excellent infrastructure, reliable public services, and high medical standards, but those qualities do not eliminate the financial risks that travelers face when accidents, illnesses, delays, or unexpected changes occur during a trip.

This article was written with an educational purpose, aiming to explain in clear and structured language what travel insurance actually covers, how travel insurance Europe policies usually work, and how to choose a plan that fits your personal travel profile without paying for unnecessary extras.

Instead of promoting fear or overselling protection, this guide focuses on understanding, helping you evaluate risks realistically and make informed decisions based on how you travel, where you go, and what would cause you the most stress if something went wrong.

The goal is to ensure that by the end of this guide, you understand travel insurance well enough to decide confidently whether you need it, what kind of coverage makes sense, and how to prepare your documents before traveling to France.

Why Travel Insurance Matters When Traveling to France

Many travelers assume that visiting a developed country automatically means lower risk, but travel insurance is not about the destination’s quality, it is about protecting yourself against situations that are unpredictable by nature.

Even in a country as organized as France, unexpected events can quickly generate costs that far exceed the price of an insurance policy.

Common Situations Where Travel Insurance Helps

- Sudden illness requiring medical care.

- Accidents during sightseeing or transportation.

- Flight delays or cancellations.

- Lost or delayed luggage.

- Emergency return to home country.

Insurance transforms uncertainty into manageable outcomes.

Is Travel Insurance Mandatory for France?

Whether travel insurance is mandatory depends on your nationality, length of stay, and visa requirements, which is why many travelers receive conflicting advice.

Situations Where Travel Insurance Is Required

- Travelers applying for a Schengen visa.

- Long-stay visa applicants.

- Certain student or work visas.

In these cases, insurance must meet specific minimum coverage standards.

Situations Where Travel Insurance Is Not Mandatory

- Visa-free tourists.

- Short stays under 90 days for eligible nationalities.

Optional does not mean unnecessary.

Understanding the Schengen Area and Insurance Requirements

France is part of the Schengen Area, which is a group of European countries that share common border rules and travel regulations.

This means that travel insurance Europe policies often apply not only to France, but to multiple countries within the same trip.

Basic Schengen Insurance Requirements

- Coverage valid across all Schengen countries.

- Medical coverage meeting minimum limits.

- Coverage for emergency medical repatriation.

Understanding these standards helps avoid policy rejection.

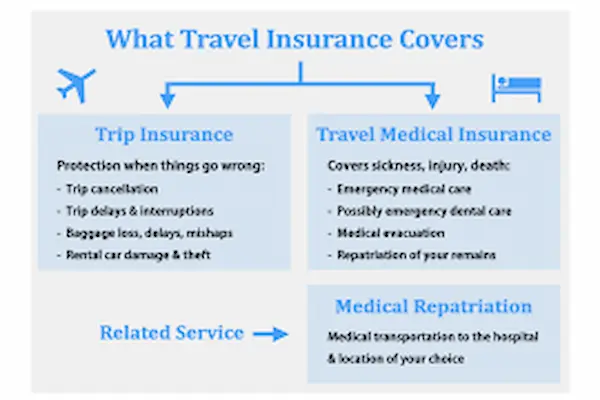

Main Types of Travel Insurance for France

Travel insurance is not a single product, but a combination of different coverages that can be adjusted according to your needs.

Medical Travel Insurance

Medical coverage is the foundation of most travel insurance policies and often the most important element.

- Emergency medical treatment.

- Hospital stays.

- Doctor consultations.

- Prescribed medication.

Healthcare costs for non-residents can be high.

Emergency Medical Evacuation and Repatriation

This coverage handles transportation to appropriate medical facilities or return to your home country if medically necessary.

- Medical evacuation within France.

- Repatriation to home country.

These services are expensive without insurance.

Trip Cancellation and Interruption Insurance

This type of coverage protects prepaid expenses if your trip is canceled or cut short for covered reasons.

- Illness before departure.

- Family emergencies.

- Unexpected travel restrictions.

Refunds are not guaranteed without protection.

Baggage and Personal Belongings Coverage

Lost, stolen, or delayed luggage is inconvenient and costly.

- Compensation for lost baggage.

- Essential purchases due to delay.

This coverage reduces stress during transit.

Travel Delay Coverage

Delays can result in additional expenses that insurance may cover.

- Accommodation due to delays.

- Meals during extended waits.

Small disruptions can escalate quickly.

How Much Coverage Is Enough for France?

Choosing coverage amounts requires balancing legal requirements, personal comfort, and realistic risk assessment.

Medical Coverage Amounts

- Minimum coverage often required for visas.

- Higher coverage recommended for peace of mind.

Healthcare quality does not reduce costs.

Non-Medical Coverage Considerations

- Value of prepaid travel.

- Cost of personal belongings.

Coverage should match exposure.

Who Especially Benefits From Travel Insurance for France

While insurance can benefit most travelers, certain profiles gain particular value from comprehensive coverage.

Travelers Who Should Strongly Consider Insurance

- First-time international travelers.

- Older travelers.

- Families with children.

- Travelers with pre-existing conditions.

- Long-stay visitors.

Risk tolerance varies by individual.

Common Misconceptions About Travel Insurance Europe

“I’m Healthy, So I Don’t Need Insurance”

Health status does not eliminate accidents.

“My Credit Card Covers Everything”

Credit card coverage is often limited.

“France Has Free Healthcare”

Healthcare is not free for tourists.

What Travel Insurance Usually Does Not Cover

Understanding exclusions is as important as understanding coverage.

Common Exclusions

Pre-existing conditions without coverage.

High-risk activities.

Non-emergency cosmetic procedures.

Incidents involving illegal behavior.

Reading policy details prevents surprises.

How to Choose the Right Travel Insurance for France

Selecting insurance should follow a structured process rather than an impulse purchase.

Step-by-Step Selection Approach

- Define trip length and destinations.

- Identify personal risk factors.

- Estimate value of trip expenses.

- Compare coverage types.

- Review exclusions carefully.

Clarity simplifies decisions.

Travel Insurance Documents to Carry

Insurance is only useful if you can access it when needed.

Essential Insurance Documents

- Policy certificate.

- Emergency contact numbers.

- Coverage summary.

Keep both digital and printed copies.

What to Do If You Need Medical Care in France

Knowing how to act during an emergency improves outcomes.

Basic Steps

- Seek medical assistance immediately.

- Contact insurance provider as soon as possible.

- Keep all receipts and documents.

Documentation supports reimbursement.

Travel Insurance and Everyday Care in France

Not all medical visits require emergency services.

Routine Medical Situations

- Pharmacy consultations.

- Doctor visits for minor issues.

Insurance may reimburse eligible expenses.

Special Considerations for Long Trips or Multiple Countries

Travelers visiting multiple European countries should ensure coverage validity throughout the entire journey.

Multi-Country Coverage Tips

- Confirm policy applies to all destinations.

- Check maximum trip duration.

Consistency avoids gaps.

Cost of Travel Insurance Compared to Potential Risks

One of the most effective ways to evaluate insurance is to compare its cost to potential out-of-pocket expenses.

Typical Expense Comparisons

- Insurance premium versus hospital stay.

- Insurance cost versus emergency flight.

Perspective clarifies value.

Common Mistakes When Buying Travel Insurance for France

Buying the Cheapest Option Without Review

Low cost often means limited coverage.

Ignoring Exclusions

Details matter most during claims.

Purchasing Too Late

Some benefits require early purchase.

Pre-Departure Travel Insurance Checklist

Before Purchase

- Review trip details.

- Assess personal health needs.

After Purchase

- Save policy documents.

- Share details with travel companions.

Before Departure

- Verify coverage dates.

- Confirm emergency contact access.

Frequently Asked Questions About Travel Insurance for France

Do I really need travel insurance for France?

It depends on risk tolerance, but it is strongly recommended.

Is travel insurance Europe-wide or country-specific?

Most policies cover multiple countries.

Can I buy insurance after arriving?

Many policies require purchase before travel.

Final Thoughts: Traveling to France With Confidence and Protection

Choosing appropriate travel insurance for France is not about expecting problems, but about acknowledging that international travel involves variables beyond personal control.

When travelers understand the types of coverage available, how travel insurance Europe policies function, and what documents to prepare, they gain peace of mind that allows them to enjoy France fully and responsibly.

A cautious traveler plans not only for the best moments, but also for unlikely challenges, ensuring that even if something unexpected happens, the journey remains manageable and secure.

Have you evaluated which type of travel insurance coverage would make you feel most confident during your trip to France?